Tax assistance and consultancy

Tarigo e Associati assists Clients in filing tax returns and other tax communications, such as, for example:

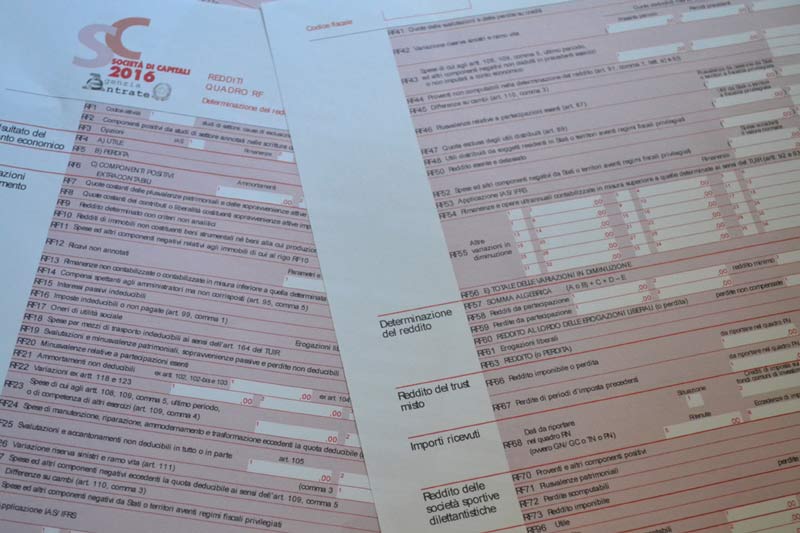

- income tax returns (for individuals, corporates and others entities), including italians “Sector studies”, 770 (simplified and standard) and IRAP returns;

- Value Added Tax (VAT) returns, including VAT returns for the Value Added Tax group, EU Intrastat declarations, etc.;

- inheritance tax returns;dichiarazioni di successione;

- local taxes (IMU, TASI, etc.) returns.

The Firm offers domiciliation services for individuals, corporates and other entities, resident and non-resident.

It also offers assistance in tax claim procedures and, in order to allow the compensation of tax credits of its Clients, the Firm provides tax advice applying the Italian “Visto di conformità” on tax returns and, for non-resident, fulfills their VAT obligations as VAT fiscal representative.

The Firm provides assistance and advice in all tax matters, also issuing opinions, included opinions “pro-veritate”, as regard this area.

Assistance and consultancy is given, moreover, in administrative procedures before the tax authorities during access and inspections, as well as for appearance requests, production of documents, answers to questionnaires and, in general, in all activities connected with assessment and collection procedures of taxes.

As part of its special competence in international taxation, the Firm assists enterprises with international activities in procedures for issuing advance tax rulings and advance price agreements with the tax authorities.

The tax consultancy covers also tax due diligence activities and tax auditing.

Tarigo e Associati also provides assistance and advice in pre-judicial tax settlements and in tax litigation proceedings before local tax Courts (Commissioni Tributarie Provinciali e Regionali).